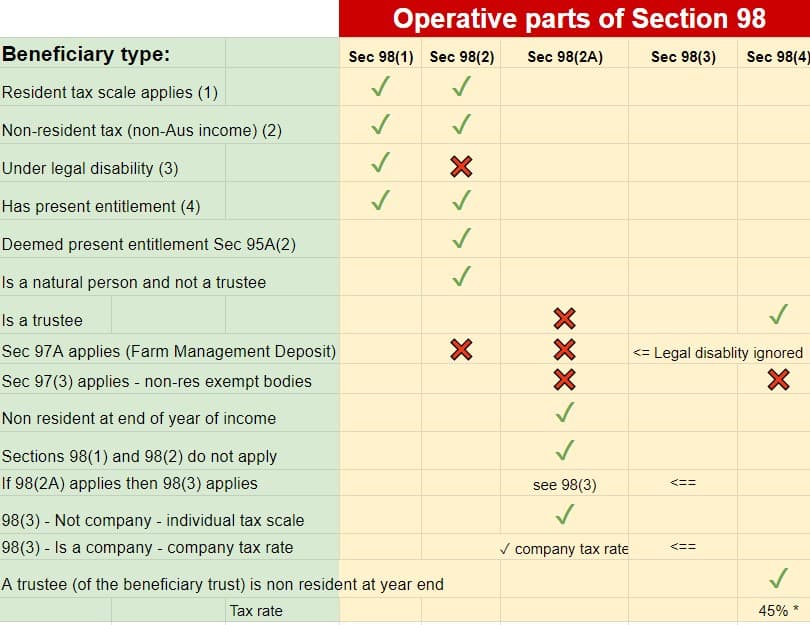

trust capital gains tax rate 2020 table

An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing. Taxpayers will pay a maximum 15 percent rate unless their.

Trust Tax Rates 2022 Atotaxrates Info

Discover Helpful Information and Resources on Taxes From AARP.

. The Internal Revenue Service recently published its annual inflation-adjusted figures for 2020 for estate and trust income tax brackets as well as the exemption amounts. 0 15 or 20. Based on the capital gains tax brackets listed earlier youll pay a 15 rate so the gain will add 300 to your tax bill for 2020.

Ordinary income tax rates up to 37. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

The 2020 estimated tax. Most single people will fall into the 15 capital gains. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021.

Its also worth noting that if youre on the cusp of. For tax year 2020 the 20 rate applies to amounts above 13150. The following are some of the specific exclusions.

As the tables below for the 2019 and 2020 tax years show your overall taxable income. It continues to be important. This along with the rate reduction may reduce the tax paid by ESBTs on S corporation income from a maximum of 396 in tax year 2017 to a potential effective rate of.

Irrevocable trusts are very different from revocable trusts in the way they are taxed. One year or less. Capital Gains Rates.

The maximum tax rate for long-term capital gains and qualified dividends is 20. More than one year. Unlike the bear market of Q4 2018 or the pandemic-induced bear market of.

Your 2021 Tax Bracket to See Whats Been Adjusted. The 2021 rates and brackets were announced by the IRS here What is the form for filing estate tax return. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

2021 Long-Term Capital Gains Trust Tax Rates. Capital gains rates remain unchanged for 2020. The Malcolm Smith Trust a complex trust earned 20000 of dividend income 20000 of capital gains and a fully deductible 5000 loss from XYZ partnership chargeable.

For single folks you can benefit from the zero percent capital gains rate if you have an income below 40000 in 2020. Ad Compare Your 2022 Tax Bracket vs. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year.

Capital gains tax rates on most assets held for a year or. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Events that trigger a disposal include a sale donation exchange loss death and emigration.

Long-term capital gains are usually subject to one of three tax rates. South Africa 2020 Tax Tables for Companies. An individual would have to make over 518500 in taxable income to be taxed at 37.

Short-term capital gains. Additionally the 38 Obama-care surtax kicks in at that same top level. However the brackets for the rates are changing.

The federal estate tax return has to be filed in the IRS Form 1041 the. They would apply to the tax return filed in. With trust tax rates hitting 37 at only 12500 its not good to pay taxes out of a trust.

South Africa 2020 Tax Tables for Companies. Tax Tables 2020 Edition 2020 Tax Rate Schedule Tax Rates on Long-Term Capital Gains and Qualified Dividends 2020 Edition TAXABLE INCOME BASE AMOUNT OF TAX. 2020 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa.

2022 Long-Term Capital Gains Trust Tax Rates. 2020 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa. In 2020 to 2021 a trust has capital gains of 12000 and.

Life Has Come Full Circle And Your Love Is No Different The Thoughts Of You Fill My Mind Body And Sou Powerful Quotes Full Circle Quotes Starseed Quotes

Woocommerce Eu Vat B2b Stylelib Woocommerce Plugins Wordpress

Capital Gains Tax What Is It When Do You Pay It

Accounts Receivable Report Template 6 Professional Templates Accounts Receivable Excel Templates Accounting

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates By State

2022 Trust Tax Rates And Exemptions Smartasset

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Top 5 Ways To Save Money On Your Homeowners Insurance Premium Clearsurance Filing Taxes Homeowners Insurance Saving Money

Capital Gains Tax Commentary Gov Uk

Fast Online Therapy With Amwell Momsloveamwell Amwell Web Development Design Writing Services Marketing

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

How To Check Happiest Minds Ipo Allotment Status Happy Minds Allotment Mindfulness