what is the inheritance tax rate in virginia

Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. Virginia does not have an inheritance tax.

Utah Protective Orders And Divorce Child Custody Family Law Attorney Attorneys

Suppose you have an estate worth 13 million.

. This is great news for Virginia residents. What is the inheritance tax in Virginia. The top estate tax rate is 20 percent exemption threshold.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Counties in virginia collect an average of 074 of a propertys assesed fair market value as property tax per year. Answered in 7 minutes by.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. Virginia inheritance laws uniquely include a probate tax in the probate process that is based off the value of the estate in question.

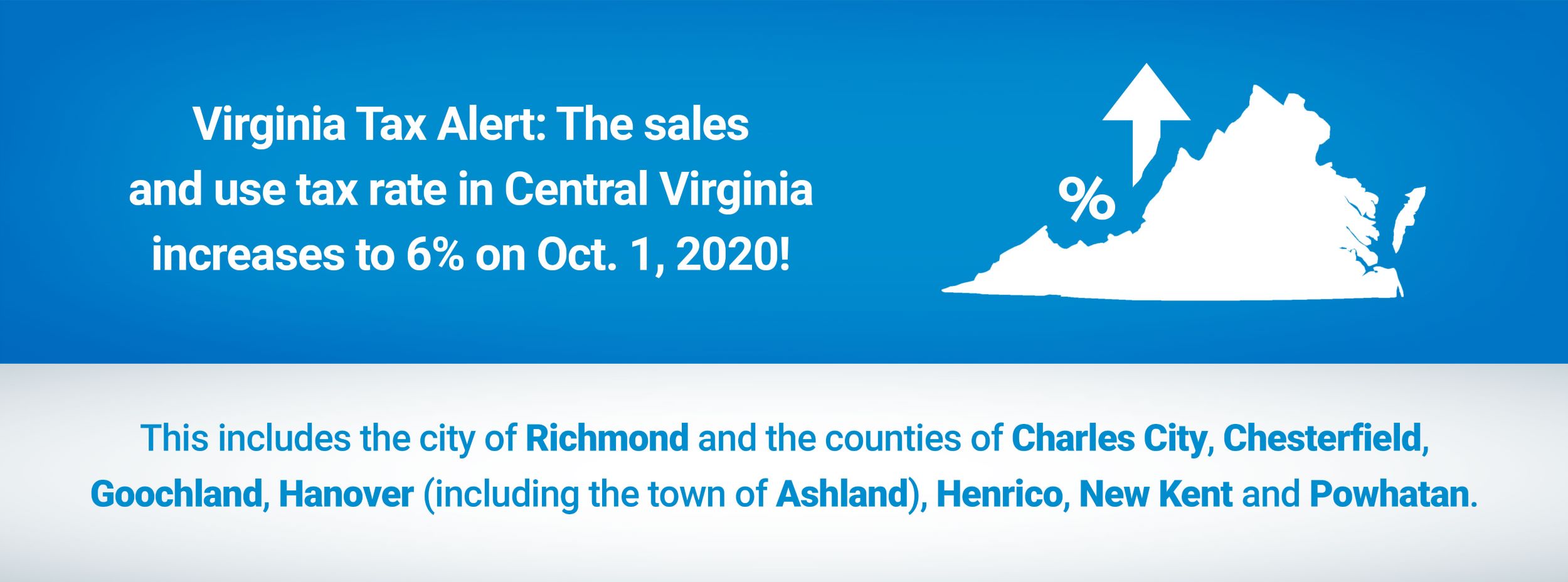

The state income tax rates range from 0 to 853 and the sales tax rate is 6. There is no federal inheritance tax but there is a federal estate tax. But just because Virginia does not have an estate tax does not mean one is not assessed at the federal level.

Inheritances that fall below these exemption amounts arent subject to the tax. See the Virginia Estate and Inheritance Taxes section of Public Document 15-93 for more information. Iowas estate tax was repealed in 2008.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Virginia. Ask Your Own Tax Question. Surviving spouses are always exempt.

Generally Virginia charges a state sales tax of 53. Decedent means a deceased person. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

Keep reading for all the most recent estate and inheritance tax rates by state. 56 million West Virginia. Today virginia no longer has an estate tax or inheritance tax.

Local rates can climb as high as 7 though and the average total rate is close to 9. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Unemployment compensation benefits 602-600 Code of Virginia Public assistance payments 632-506 Code of Virginia Workers compensation 652-531 Code of Virginia Child support payments 20.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Form 92a200 92a202 or 92a205. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Key findings A federal estate tax ranging from 18 to 40. With the elimination of the federal credit the Virginia estate tax was effectively repealed.

There is no gift tax in West Virginia and this fact became an essential part of the estate planning strategy for people with properties that exceed the federal estate tax exemption and therefore become subject to the federal estate tax. These states have an inheritance tax. No estate tax or inheritance tax.

Maryland is the only state to impose both. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. Another states inheritance tax may apply to you if the person leaving you money lived in a state that levies inheritance tax.

The District of Columbia moved in the. As used in this chapter unless the context clearly shows otherwise the term or phrase. The advantages of an inheritance cash advance in West Virginia include.

In 2021 federal estate tax generally applies to assets over 117 million. Virginia Estate Tax. Although there is no inheritance tax in oklahoma you.

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. The estate tax exemption for New York increases to 611 million while that for Washington state remains unchanged at nearly 220 million. If no family members outlive you the state of West Virginia inherits the intestate estate.

No estate tax or inheritance tax. Virginia taxes capital gains at the same income tax rate up to 575. Contact us if you believe you have exempted funds affected by a lien.

Today Virginia no longer has an estate tax or inheritance tax. A few states have disclosed exemption limits for 2022. Oklahoma inheritance tax rate.

Virginia currently does not levy an inheritance tax. The estate tax rate is 40 so you should do everything in your power to minimize any estate tax exposure. The income tax rate in virginia ranges from 2 to 57.

Virginia does not have an inheritance tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. The top estate tax rate is 20 percent exemption threshold.

There is no federal inheritance tax but there is a federal estate tax. If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. No estate tax or inheritance tax.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Virginia is ranked number twenty one out of the fifty states in. See the Virginia Estate and Inheritance Taxes section of Public Document 15-93 for more information.

2193 million Washington DC District of Columbia. Virginia Inheritance and Gift Tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Ad Find Visit Today and Find More Results. Virginia inheritance laws uniquely include a probate tax in the probate process that is based off the value of the estate in question. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption.

So if your estate. State inheritance tax rates range from 1 up to 16. Pennsylvania has a tax that applies to out-of-state inheritors for example.

The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1. The federal gift tax exemption is 15000 per recipient each year for. The top estate tax rate is 16 percent exemption threshold.

The state with the highest inheritance tax rate is Nebraska with a rate that tops out at 18. Gift tax and inheritance tax in West Virginia. Do we have to declare if over or under certain limits.

Most often this is a 1 state tax and 033 local tax for every 1000 within the estate. Theres also no gift tax in Virginia.

Tennessee Retirement Tax Friendliness Smartasset Com Federal Income Tax Income Tax Return Inheritance Tax

State Tax Proposals Would Make Virginia S Tax System More Fair The Commonwealth Institute The Commonwealth Institute

How Do State And Local Sales Taxes Work Tax Policy Center

2020 Estate And Gift Taxes Offit Kurman

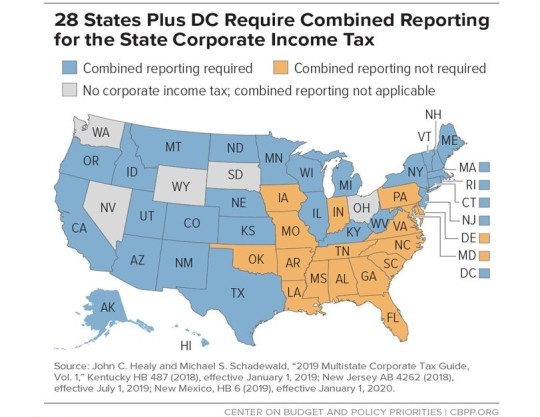

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

The Top Tax Rate Has Been Cut Six Times Since 1980 Usually With Democrats Help The Washington Post

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Virginia Estate Tax Everything You Need To Know Smartasset

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How Is Tax Liability Calculated Common Tax Questions Answered

Estate Taxes They Re Not Dead Yet C Douglas Welty Plc

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die